From Lew Rockwell’s ‘Why Austrian Economics Matters‘

The concepts of scarcity and choice lie at the heart of Austrian economics. Man is constantly faced with a wide array of choices. Every action implies forgone alternatives or costs. And every action, by definition, is designed to improve the actor’s lot from his point of view. Moreover, every actor in the economy has a different set of values and preferences, different needs and desires, and different time schedules for the goals he intends to reach.

The needs, tastes, desires, and time schedules of different people cannot be added to or subtracted from other people’s. It is not possible to collapse tastes or time schedules onto one curve and call it consumer preference. Why? Because economic value is subjective to the individual.

Similarly, it is not possible to collapse the complexity of market arrangements into enormous aggregates. We cannot, for example, say the economy’s capital stock is one big blob summarized by the letter K and put that into an equation and expect it to yield useful information. The capital stock is heterogeneous. Some capital may be intended to create goods for sale tomorrow and others for sale in ten years. The time schedules for capital use are as varied as the capital stock itself. Austrian theory sees competition as a process of discovering new and better ways to organize resources, one that is fraught with errors but that is constantly being improved.

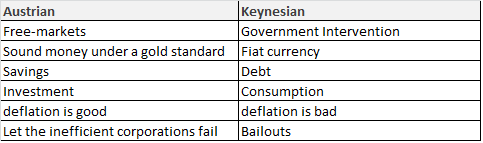

This way of looking at the market is markedly different from every other school of thought. Since Keynes, economists have developed the habit of constructing parallel universes having nothing to do with the real world. In these universes, capital is homogeneous and competition is a static end state. There are the right number of sellers, prices reflect the costs of production, and there are no excess profits. Economic welfare is determined by adding up the utilities of all individuals in society. The passing of time is rarely accounted for, except in changing from one static state to another. Varying time schedules of producers and consumers are simply nonexistent. Instead we have aggregates that give us precious little information at all.

A conventional economist is quick to agree that these models are unrealistic, ideal types to be used as mere tools of analysis. But this is disingenuous, since these same economists use these models for policy recommendations.

One obvious example of basing policy on contrived models of the economy takes place at the Justice Department’s antitrust division. There the bureaucrats pretend to know the proper structure of industry, what kind of mergers and acquisitions harm the economy, who has too much market share or too little, and what the relevant market is. This represents what Hayek called the pretense of knowledge.

The correct relationship between competitors can only be worked out through buying and selling, not bureaucratic fiat. Austrian economists, in particular Rothbard, argue that the only real monopolies are created by government. Markets are too competitive to allow any monopolies to be sustained.

Another example is the idea that economic growth can be manufactured by manipulating aggregate demand curves through more and faster government spending considered to be a demand booster instead of a supply reducer or government bullying of the consuming public.

If the hallmark of conventional economics is unrealistic models, the hallmark of Austrian economics is a profound appreciation of the price system. Prices provide economic actors with critical information about the relative scarcity of goods and services. It is not necessary for consumers to know, for example, that a disease has swept the chicken population to know that they should economize on eggs. The price system, by making eggs more expensive, informs the public of the appropriate behavior.

The price system tells producers when to enter and leave markets by relaying information about consumer preferences. And it tells producers the most efficient that is, the least costly way to assemble other resources to create goods. Apart from the price system, there is no way to know these things.

But prices must be generated by the free market. They cannot be made up the way the Government Printing Office makes up the prices for its publications. They cannot be based on the costs of production in the manner of the Post Office. Those practices create distortions and inefficiencies. Rather, prices must grow out of the free actions of individuals in a juridical setting that respects private property.

Neoclassical price theory, as found in most graduate texts, covers much of this territory. But typically, it takes for granted the accuracy of prices apart from their foundation in private property. As a result, virtually every plan for reforming the post-socialist economies talked about the need for better management, loans from the West, new and different forms of regulation, and the removal of price controls, but not private property. The result was the economic equivalent of a train wreck.

Free-floating prices simply cannot do their work apart from private property and concomitant freedom to contract. Austrian theory sees private property as the first principle of a sound economy. Economists in general neglect the subject, and when they mention it, it is to find a philosophical basis for its violation.

The logic and legitimacy of “market failure” analysis, and its public-goods corollary, is widely accepted by non-Austrian schools of thought. The notion of public goods is that they cannot be supplied by the market, and instead must be supplied by government and funded through its taxing power. The classic case is the lighthouse, except that, as Ronald Coase has shown, private lighthouses have existed for centuries. Some definitions of public goods can be so broad that, if you throw out common sense, everyday consumer goods qualify.

Austrians point out that it is impossible to know whether or not the market is failing without an independent test, of which there is none outside the actions of individuals. The market itself is the only available criterion for determining how resources ought to be used.

Let’s say I deem it necessary, for various social reasons, that there be one barber for every 100 people and, as I look around, I notice that this is not the case. Thus I might advocate that a National Endowment for Barbers be established to increase the barber supply. But the only means for knowing how many barbers there ought to be is the market itself. If there are fewer than one per hundred, we must assume that a larger number is not supposed to exist by any reasonable standard of efficient markets. It is not economically proper to develop a wish list of jobs and institutions that stands apart from the market itself.