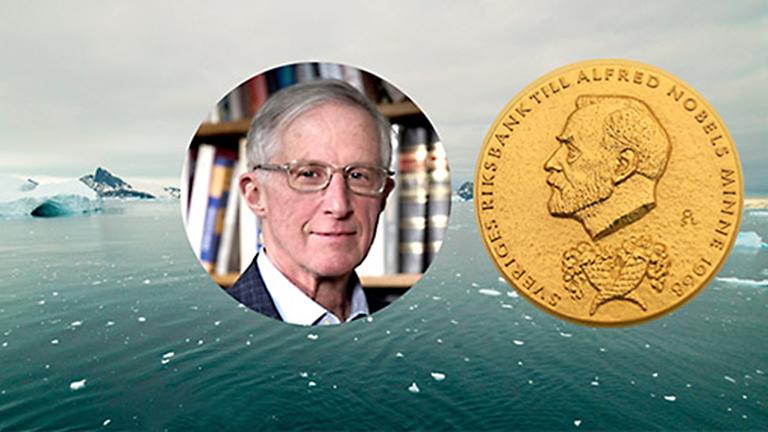

Review of ‘The Spirit of Green’ written by the fake economist and fake ‘Nobel’ prize winner William Nordhaus

“Happy families are all alike,” goes the Leo Tolstoy quote from the Russian classic Anna Karenina, “but every unhappy family is unhappy in its own way.”

The same can be said about government-focused technocrats and their central planning tendencies: all happy technocrats are alike, but every unhappy citizen-subject living under their rule is unhappy in his or her own way.

Whatever the topic, technocrats follow the same time-honored formula: they find an issue they dislike and blame it on greed, the market, or some iconic industrialist before resolutely delivering their “urgent” policy solutions, without which civilization is ostensibly doomed.

William Nordhaus, the environmental economist and 2018 Nobel Laureate, fills this role perfectly. In the book he recently published, The Spirit of Green, he covers the philosophy and ethics of a green world and how it applies to economics—to markets, taxes, regulations, and most perniciously externalities. Whatever the precise issue Nordhaus considers, a government solution is never far away—even if it occasionally works through manipulating market mechanisms. Ultimately, technocrats like our professor here want to nudge, outlaw, regulate, and tax things they don’t like while subsidizing, funding, and encouraging those they do.

Despite being the author of a long-standing economics textbook, Nordhaus manages to butcher several economic concepts, most egregiously costs and values, principal-agent problems, public goods, and externalities. We’ll deal with externalities in this article, public goods in the next, and Nordhaus’s struggle with costs, values, and prices in the final one.

The first mistake happens before he’s barely begun (on p. 2), where we get the usual praise for “mixed economies”:

[S]ocieties need to combine the ingenuity of private markets with the fiscal and regulatory powers of governments. Private markets are necessary to provide ample supplies of goods such as food and shelter, while only governments can provide collective goods such as pollution control, public health, and personal safety.

As a description of the ideology held by interventionists like Professor Nordhaus, this is accurate. As a statement about the world, economics, or markets, it’s entirely false: there exist very few collective goods; pollution control can and is alleviated privately or through private courts and only individuals, not collectives, have health or safety.

Most other errors in Nordhaus’s eloquent text follow from these initial mistakes.

The Many Shapes of External Damage

At the first chance he gets, Nordhaus treats public goods and externalities as seemingly meaning the same thing, “activities whose costs or benefits spill outside the market and are not captured in market prices.”

This is close to how many economists think about the concept (whether or not they think it a useful theoretical lens). From Greg Mankiw’s textbook we get that “externality is the impact of one person’s actions on the well being of a bystander”; from Wikipedia, that “an externality is a cost or benefit for a third party who did not agree to it.”

Further into the book, externalities have gotten an expanded meaning. They’re a “by-product of an economic activity that causes damages to innocent bystanders,” like the Mankiw formulation. Two chapters earlier, externalities occurred when costs of activities spill over to others “without those other people being compensated for the damages.”

What’s it going to be? Is it all activities affecting others? Just market activities? Just market activities to which the third-party individual objects? That these others aren’t being compensated? Much too imprecise for the only laureate in environmental economics, but we’re still roughly on board with the general meaning of market activities imposing damage on an innocent third party.

Then Nordhaus runs with his newfound conceptual justification for government action. Congested traffic is an externality. An entire segment in The Spirit of Green displays network externalities, of which Facebook might be the example that first comes to mind (the value to the user increases with the number of other users joining the network). Then we have “pecuniary externalities,” which are any (negative) economic impact on you from other people’s actions—from competitors opening a store to a consumer importing better products from abroad. Gas stations, Nordhaus says, are externalities. As are ATMs, street litter, traffic noise—oh, and most certainly the pandemic, which gets a full twenty-page chapter in a book about climate economics. Go figure.

My favorite one is obesity, which is now treated as a negative externality from driving. We may accept that a sedentary lifestyle has undesired consequences and “harmful side effects”—but does that really make these effects externalities which governments then have carte blanche to rectify?

But it gets worse. Nordhaus shows absolutely no familiarity with how markets routinely internalize external damages—whether it is individuals opting out, litigation or enforced property rights, negotiations between people, or how market prices on land or homeowners’ associations adjust in response to consumers’ valuation of that supposed external damage.

Or, more importantly, from knowingly opting into an activity, despite there being negative externalities involved. I had to bang my head against the wall when he brought up “marrying a smoker” as a negative personal spillover—as if I weren’t aware that my partner is smoking! My increased exposure to dangerous compounds in cigarette smoke is thus a side effect: these are constrained optimizations, professor, across several distinct domains—not externalities. I take the bad with the good, and make the calculus that it’s still worth it. To his (very minor) credit, marrying a smoker is related to a set of externalities that he thinks only operate at a personal level and so need not concern others.

At a different passage he also explores which externalities one ought to care about: “Nations cannot and should not regulate every minor externality, such as a messy yard or burping in public.”

I’m glad to hear that too, but the bad news is that Professor Nordhaus is not in a position to distinguish which negative externalities are major and which are minor. It might seem obvious that burping is fine and polluting rivers isn’t, but that’s the all-knowing technocrat speaking—not the acting man making subjective valuations under conditions of uncertainty. A central planner cannot know.

The minute we then take pecuniary externalities into account, anything inside or outside the marketplace is no longer ours to decide. In discussing pecuniary externalities, Nordhaus has already given us a criterium for which externalities are permissible in his well-managed society and which we ought to overlook: “[B]enefits to society from actions that cause pecuniary externalities are generally higher than are the costs to persons who suffer pecuniary externalities.” Finally, a cost-benefit test. So, if fossil fuels benefit enough people in sufficient proportions—which they overwhelmingly do—any residual externalities are okay. Great—cancel the 26th United Nations Climate Change Conference, please.

If everything is an externality, the concept becomes rather meaningless. More importantly, it lets technocrats and governments arbitrarily invoke it when issuing commands they like while refusing to invoke it for their opponents’ commands.

If the role of governments is to correct externalities in markets and everything is an externality, there are few hurdles left for governments to dismantle; anything is up for grabs. Everything is political; nothing is above or outside the scope of the all-seeing political master.

Like a good technocrat, Nordhaus wishes to sit not on the throne but right next to it, eagerly advising the ruler on what is “obviously” the best solution to a certain problem. His lack of faith in individuals, firms, and markets to achieve beneficial ends is stunning:

[P]eople may cough and die, firms may prosper or fail, species may disappear, and lakes may catch on fire. But until governments, through the appropriate mechanisms, take steps to control the polluting causes, the dangerous conditions will continue.

Externalities are everywhere. And for a technocratic planner, that’s the point.