By Frank Shostak on the Mises Wire

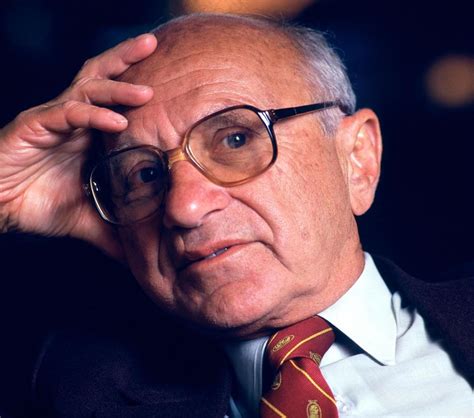

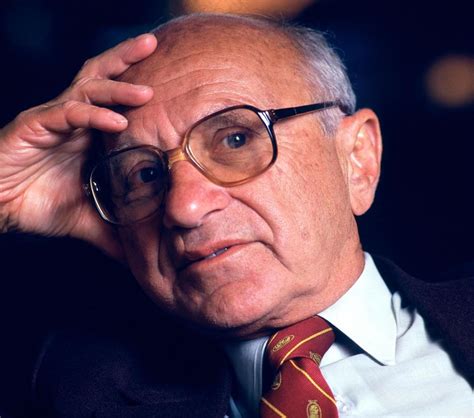

According to an article in Bloomberg on November 5, 2019, Milton Friedman’s business cycle theory seems to be vindicated.

According to Milton Friedman, strong recoveries are just natural after particularly deep recessions. Like a guitar string, the harder the string is plucked down, the faster it should come back up.

Bigger recessions should lead to faster growth rates during the recoveries, to get the economy back to the pre-recession level of activity. In Friedman’s model, the size of the recession predicts the growth rate in the recovery.1

The Bloomberg article refers to a study by Tara Sinclair that employs advance mathematical techniques that supposedly confirmed Friedman’s hypothesis that in the US bigger recessions are followed by faster recoveries — but not the other way around. According to Bloomberg some other researchers found similar results for other countries.

On this way of thinking, views such as those presented by Ludwig von Mises that the magnitude of an economic bust is because of the magnitudes of the previous boom is false.

Contrary to Mises, a common view is the bust is caused by various mysterious factors that have nothing to do with the previous boom. But that the main problem with the Friedman’s model is the lack of a coherent definition of what a boom-bust cycle really is.

Defining Boom-Bust Cycles

In a free, unhampered market, we could envisage that the economy would be subject to various shocks, but it is difficult to envisage a phenomenon of recurrent boom-bust cycles. According to Rothbard,

Before the Industrial Revolution in approximately the late 18th century, there were no regularly recurring booms and depressions. There would be a sudden economic crisis whenever some king made war or confiscated the property of his subjects; but there was no sign of the peculiarly modern phenomena of general and fairly regular swings in business fortunes, of expansions and contractions.

The boom-bust cycle phenomenon is somehow linked to the modern world. But what is the link? The source of the recurring boom-bust cycles turns out to be the alleged “protector” of the economy — the central bank itself. A loose central bank monetary policy, which results in an expansion of money out of “thin air” sets in motion an exchange of nothing for something, which amounts to a diversion of real wealth from wealth-generating activities to non-wealth-generating activities. In the process, this diversion weakens wealth generators, and this in turn weakens their ability to grow the overall pool of real wealth.

The expansion in activities that are based on loose monetary policy is what an economic “boom” (or false economic prosperity) is all about. Note that once the central bank’s pace of monetary expansion strengthens the pace of the diversion of real wealth is also going to strengthen.

Once however, the central bank tightens its monetary stance, this slows down the diversion of real wealth from wealth producers to non-wealth producers. Activities that sprang up on the back of the previous loose monetary policy are now getting less support from the money supply; they fall into trouble — an economic bust or recession emerges.

Contrary to Friedman, it is not possible to have an economic bust without the emergence of the previous boom. Again the subject matter of boom-bust cycles are various activities that emerged on the back of central bank policies. These activities, which we label as bubble activities, are preceded by monetary policies of the central bank, which in turn tends to manifest itself by means of the yearly growth of money supply and the height of interest rates.

Loose monetary policies are likely to manifest in the strengthening of the annual growth of money supply and a decline in the policy interest rate. A tighter monetary stance is likely to manifest in the decline in the annual growth of money supply and in the increase in the policy interest rate.

Again, a loose monetary stance, and a subsequent increase in the momentum of money supply results in the increase in bubble activities while a tighter stance leads to their demise.

On this way of thinking an increase in bubbles cannot emerge during a tighter monetary stance. On the contrary, a tighter stance will lead to a demise of the bubbles. Obviously then it does not make much sense as the Friedman’s business cycle model suggests that an economic boom is caused by the previous bust.

So how then we are to respond to various sophisticated empirical studies, which support Friedman’s theory?

To suggest that the boom-bust cycle can be depicted by a guitar string — the harder the string is plucked down, the faster it should come back — is not different from the hypothetical case where if a dog barks four times this preceded an economic recession and if a dog barks two times prosperity was followed suit. Note that the dog-barking example to explain boom-bust cycles is as ridiculous as the example of the guitar string. To explain a phenomenon one needs to identify the key factors that are responsible for this phenomenon. Obviously, a guitar string has nothing to do here with the emergence and the demise of bubble activities.

Hence, regardless of the mathematical sophistication if the underlying logic of the analysis is flawed then the outcome of the analysis must be rejected.

- 1. See Economic Inquiry, April 1993, 171-77