By Simone Wapler on Countrepoints.org

Translated from the original in French

In China and France, a tightly-controlled mini private sector is allowed to exist alongside a monstrous public sector “skillfully” piloted by the bureaucracy approved by the government.

After a long time in the “good books” of the Chinese government, Jack Ma, founder of Alibaba and the Alipay payment system, owner of Ant Group before its IPO, has now fallen out of favor. On Chinese social networks he has become an “evil capitalist” or a “bloodsucking ghost”.

This is a backlash which the authorities wanted. It is likely that Jack Ma’s group will be nationalized.

Many French people forget it, but China remains a dictatorship. The country has tried the experiment of crony capitalism: partially allowing private, unplanned but closely watched activity to flourish in reserved areas.

SiecleDigital quotes an article – now censored in China – by economist Zhang Weiying, which reminds us that the activities of Chinese companies are very closely watched: “Without government permission, you cannot enter these industries.”

The country has gone from pure communism to ultra-socialism. A soft version of communism but far removed from classical liberal capitalism.

Fred Hu, shareholder and director of Ant Group, is concerned about the disappearance of economic freedoms:

“You can either have absolute control or have a dynamic and innovative economy. But it’s unlikely that you can have both.”

“Unlikely” is an understatement.

Indeed, in a genuinely free and therefore dynamic economy, the state allows self-regulation mechanisms to operate. They are three in number.

First, customers

We do not produce things which don’t have buyers since they do not not sell and therefore it would not be profitable. It is obvious, but some of these obvious things need to be remembered in our country.

The free economy relies – contrary to what its critics claim – primarily on the plebiscite of customers. Of course, I’m talking about free and unconstrained customers, not subsidized clients. In this sense, capitalism is democratic and not interventionist.

Secondly, competition

If a product or service is popular, then many entrepreneurs will try to provide it better or cheaper than the existing offering. The customer has a choice, unlike the user of ultra-socialism who wanders the dismal shelves of state stores without being able to find what he would like.

Finally, bankruptcy

If a business is not profitable – because it is not sufficiently popular with customers who are free to choose – it disappears. In doing so, it stops wasting resources, including human resources. Employees will thus sell their time to profitable companies.

If only one of these mechanisms is hampered, free market capitalism no longer works, it becomes ineffective. For these three self-regulatory mechanisms to function properly, the legislation must be adapted, so that it protects the property, freedom and safety of everyone, without exception, without interference, without privilege, without subsidy (favoritism) or taxation (sanction) of this or that group of individuals.

A nationalized or subsidized enterprise escapes self-regulation mechanisms. This explains the troubles of Air France, EDF, SNCF, Areva, etc, a very long list of companies much to the despair of the French taxpayer. Their captive and coerced clients do not force them to improve.

It is possible that Jack Ma fell victim to his audacity by offering to buy bitcoin with Alipay. Private means of payment and private currency are a dangerous combination for governments who wish to have oversight over all transactions and control the quantity and exchange rate of their own currency.

Of course what you read is just a guess. However, this is not a conspiracy theory but an obvious one: Totalitarian regimes, without exception, hate monetary competition.

China and France share this tendency towards ultra-socialism. China has abandoned communism but only for conditional freedoms. Now it seems she wants to back down, abandon her ultra-socialist experience and come back to communism.

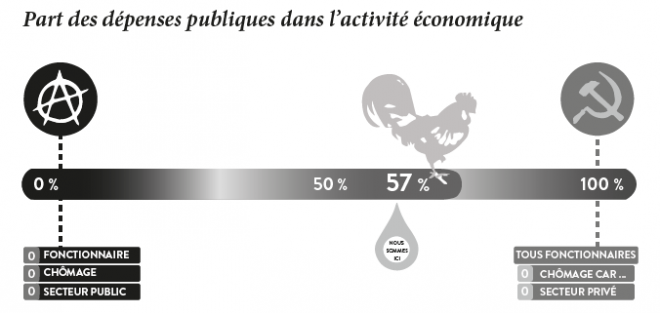

France, for its part, is making great strides towards ultra-socialism. In 2020, before the Coronavirus epidemic, 57% of economic activity was under state control. By shutting down the private sector, without ever reducing its public sector, the cursor will go even further into ultra-socialism, the antechamber of communism.

Where will the cursor be in France when the health level returns to normal? Probably around 62% state-controlled activity. Indeed, the decline in GDP was almost exclusively taken on by the private sector, the public sector remaining untouched.

62% state activity, 38% private activity, welcome to ultra-socialism! For the record, the German Democratic Republic, the economic flagship of the Soviet bloc, operated roughly with this ratio. We produced Trabant cars there, while across the border in the Federal Republic of Germany we produced Volkswagens, Mercedes, Audis …

Small joke of the time:

“Why do you always have to take the rear window defrost option on a Trabant?

So as not to freeze your hands while pushing it… ”

In France, with the coronavirus epidemic, many people see the disastrous bureaucratic management of masks, freezing, tests, care and finally vaccines and conclude that something is wrong.

Faced with this observation of failure, a part of the population – the same who denounce free markets in normal times – would like the state to intervene just as much (or even more), but differently. Converge towards the Chinese model, in a way.

On the contrary, another part of the population would like to turn its back on ultra-socialism, but the corresponding political offer is struggling to penetrate.

This is natural because political parties, mainstream media and unions do not live on their respective voters, readers and members. They all live off subsidies and their differences relate only to their respective shares of these subsidies which they intend to preserve and even increase.