Extract from Saifedean Ammous’ “The Bitcoin Standard” (footnotes ommitted)

The fundamental scam of modernity is the idea that government needs to manage the money supply. It is an unquestioned starting assumption of all mainstream economic schools of thought and political parties. There isn’t a shred of real‐world evidence to support this contention, and every attempt to manage the money supply has ended with economic disaster. Money supply management is the problem masquerading as its solution; the triumph of emotional hope over hard‐headed reason; the root of all political free lunches sold to gullible voters. It functions like a highly addictive and destructive drug, such as crystal meth or sugar: it causes a beautiful high at the beginning, fooling its victims into feeling invincible, but as soon as the effect subsides, the come‐down is devastating and has the victim begging for more. This is when the hard choice needs to be made: either suffer the withdrawal effects of ceasing the addiction, or take another hit, delay the reckoning by a day, and sustain severe long‐term damage.

For Keynesian and Marxist economists, and other proponents of the state theory of money, money is whatever the state says is money, and therefore it is the prerogative of the state to do with it as it pleases, which is going to inevitably mean printing it to spend on achieving state objectives. The aim of economic research, then, is to decide how best to expand the money supply and to what ends. But the fact that gold has been used as money for thousands of years, from before nation states were ever invented, is itself enough refutation of this theory. The fact that central banks still hold large amounts of gold reserves and are still accumulating more of it testifies to gold’s enduring monetary nature, in spite of no government mandating it. But whatever historical quibbles the proponents of the state theory of money may have with these facts, their theory has been obliterated before our very eyes over the last decade by the continued success and growth of Bitcoin, which has achieved monetary status and gained value exceeding that of most state‐backed currencies, purely due to its reliable salability in spite of no authority mandating its use as money.

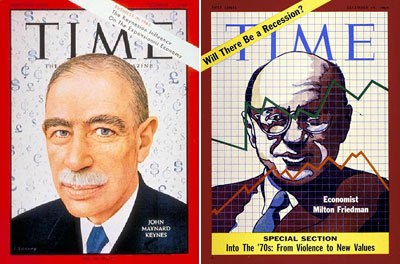

There are today two main government‐approved mainstream schools of economic thought: Keynesians and Monetarists. While these two schools have widely disparate methodologies and analytical frameworks, and while they are engaged in bitter academic fights accusing each other of not caring about the poor, the children, the environment, inequality, or the buzzword du jour, they both agree on two unquestionable truths: first, the government has to expand the money supply. Second, both schools deserve more government funding to continue researching really important Big Questions which will lead them to find ever‐more‐creative ways of arriving at the first truth.

It’s important to understand the different rationales for the two schools of thought in order to understand how they can both arrive at the same conclusion and be equally wrong. Keynes was a failed investor and statistician who never studied economics but was so well‐connected with the ruling class in Britain that the embarrassing drivel he wrote in his most famous book, The General Theory of Employment, Money, and Interest, was immediately elevated into the status of founding truths of macroeconomics. His theory begins with the (completely unfounded and unwarranted) assumption that the most important metric in determining the state of the economy is the level of aggregate spending across society. When society collectively spends a lot, the spending incentivizes producers to create more products, thus employing more workers and reaching full‐employment equilibrium. If spending rises too much, beyond the capacity of producers to keep up, it would lead to inflation and a rise in the overall price level. On the other hand, when society spends too little, producers reduce their production, firing workers and increasing unemployment, resulting in a recession.

Recessions, for Keynes, are caused by abrupt reductions in the aggregate level of spending. Keynes was not very good with grasping the concept of causality and logical explanations, so he never quite bothered to explain why it is that spending levels might suddenly drop, instead just coining another of his famous clumsy and utterly meaningless figures of speech to save him the hassle of an explanation. He blamed it on the flagging of “animal spirits.” To this day, nobody knows exactly what these animal spirits are or why they might suddenly flag, but that of course has only meant that an entire cottage industry of state‐funded economists have made a career out of attempting to explain them or finding real‐world data that can correlate to them. This research has been very good for academic careers, but is of no value to anyone actually trying to understand business cycles. Put bluntly, pop psychology is no substitute for capital theory.

Subscribe to our updates, it’s free AND ad-free ! Or join our Telegram group.

Freed from the restraint of having to find a cause of the recession, Keynes can then happily recommend the solution he is selling. Whenever there is a recession, or a rise in the unemployment level, the cause is a drop in the aggregate level of spending and the solution is for the government to stimulate spending, which will in turn increase production and reduce unemployment. There are three ways of stimulating aggregate spending: increasing the money supply, increasing government spending, or reducing taxes. Reducing taxes is generally frowned upon by Keynesians. It is viewed as the least effective method, because people will not spend all the taxes they don’t have to pay—some of that money will be saved, and Keynes absolutely detested saving. Saving would reduce spending, and reducing spending would be the worst thing imaginable for an economy seeking recovery. It was government’s role to impose high time preference on society by spending more or printing money. Seeing as it is hard to raise taxes during a recession, government spending would effectively translate to increasing the money supply. This, then, was the Keynesian Holy Grail: whenever the economy was not at full employment, an increase of the money supply would fix the problem. There is no point worrying about inflation, because as Keynes had “showed” (i.e., baselessly assumed) inflation only happens when spending is too high, and because unemployment is high, that means spending is too low. There may be consequences in the long run, but there was no point worrying about long‐term consequences, because “in the long run, we are all dead,” as Keynes’s most famous defense of high‐time‐preference libertine irresponsibility famously stated.

The Keynesian view of the economy is, of course, at complete odds with reality. If Keynes’s model had any truth to it, it would then necessarily follow that there can be no example of a society experiencing high inflation and high unemployment at the same time. But this has in fact happened many times, most notably in the United States in the 1970s, when, in spite of the assurances of Keynesian economists to the contrary, and in spite of the entire U.S. establishment, from President Nixon down to “free market economist” Milton Friedman, adopting the refrain, “We’re all Keynesians now” as the government took it upon itself to eliminate unemployment with increased inflation, unemployment kept on rising as inflation soared, destroying the theory that there is a trade‐off between these two. In any sane society, Keynes’s ideas should have been removed from the economics textbooks and confined to the realm of academic comedy, but in a society where government controls academia to a very large degree, the textbooks continued to preach the Keynesian mantra that justified ever more money printing. Having the ability to print money, literally and figuratively, increases the power of any government, and any government looks for anything that gives it more power.

The other main school of government‐approved economic thought in our day and age is the Monetarist school, whose intellectual father is Milton Friedman. Monetarists are best understood as the battered wives of the Keynesians: they are there to provide a weak, watered‐down strawman version of a free market argument to create the illusion of a climate of intellectual debate, and to be constantly and comprehensively rebutted to safely prevent the intellectually curious from thinking of free markets seriously. The percentage of economists who are actually Monetarists is minuscule compared to Keynesians, but they are given far too much space to express their ideas as if there are two equal sides. Monetarists largely agree with Keynesians on the basic assumptions of the Keynesian models, but find elaborate and sophisticated mathematical quibbles with some conclusions of the model, which exceptions always lead them to dare to suggest a slightly reduced role for government in the macroeconomy, which immediately gets them dismissed as heartless evil capitalist scum who do not care about the poor.

Monetarists generally oppose Keynesian efforts to spend money to eliminate unemployment, arguing that in the long run, the effect on unemployment will be eliminated while causing inflation. Instead, Monetarists prefer tax cuts to stimulate the economy, because they argue that the free market will better allocate resources than government spending. While this debate over tax cuts versus spending increases rages on, the reality is that both policies result in increased government deficits which can only be financed with monetized debt, effectively an increase in the money supply. However, the central tenet of Monetarist thought is for the pressing need for governments to prevent collapses in the money supply and/or drops in the price level, which they view as the root of all economic problems. A decline in the price level, or deflation as the Monetarists and Keynesians like to call it, would result in people hoarding their money, reducing their spending, causing increases in unemployment, causing a recession. Most worryingly for Monetarists, deflation is usually accompanied by collapses in the banking sector balance sheets, and because they, too, share an aversion for understanding cause and effect, it thus follows that central banks must do everything possible to ensure that deflation never happens. For the canonical treatment of why Monetarists are so scared of deflation, see a 2002 speech by former Chairman of the Federal Reserve Ben Bernanke entitled Deflation: Making Sure “It” Doesn’t Happen Here.

The sum total of the contribution of both these schools of thought is the consensus taught in undergraduate macroeconomics courses across the world: that the central bank should be in the business of expanding the money supply at a controlled pace, to encourage people to spend more and thus keep the unemployment level sufficiently low. Should a central bank contract the money supply, or fail to expand it adequately, then a deflationary spiral can take place, which would discourage people from spending their money and thus harm employment and cause an economic downturn. Such is the nature of this debate that most mainstream economists and textbooks do not even consider the question of whether the money supply should be increased at all, assuming that its increase is a given and discussing how central banks need to manage this increase and dictate its rates. The creed of Keynes, which is universally popular today, is the creed of consumption and spending to satisfy immediate wants. By constantly expanding the money supply, central banks’ monetary policy makes saving and investment less attractive and thus it encourages people to save and invest less while consuming more. The real impact of this is the widespread culture of conspicuous consumption, where people live their lives to buy ever-larger quantities of crap they do not need. When the alternative to spending money is witnessing your savings lose value over time, you might as well enjoy spending it before it loses its value. The financial decisions of people also reflect on all other aspects of their personality, engendering a high time preference in all aspects of life: depreciating currency causes less saving, more borrowing, more short‐termism in economic production and in artistic and cultural endeavors, and perhaps most damagingly, the depletion of the soil of its nutrients, leading to ever‐lower levels of nutrients in food.

In contrast to these two schools of thought stands the classical tradition of economics, which is the culmination of hundreds of years of scholarship from around the world. Commonly referred to today as the Austrian school, in honor of the last great generation of economists from Austria in its golden age pre‐World War I, this school draws on the work of Classical Scottish, French, Spanish, Arab, and Ancient Greek economists in explicating its understanding of economics. Unlike Keynesian and Monetarist fixation on rigorous numerical analysis and mathematical sophistry, the Austrian school is focused on establishing an understanding of phenomena in a causal manner and logically deducing implications from demonstrably true axioms.

The Austrian theory of money posits that money emerges in a market as the most marketable commodity and most salable asset, the one asset whose holders can sell with the most ease, in favorable conditions. An asset that holds its value is preferable to an asset that loses value, and savers who want to choose a medium of exchange will gravitate toward assets that hold value over time as monetary assets. Network effects mean that eventually only one, or a few, assets can emerge as media of exchange. For Mises, the absence of control by government is a necessary condition for the soundness of money, seeing as government will have the temptation to debase its money whenever it begins to accrue wealth as savers invest in it.

By placing a hard cap on the total supply of bitcoins, as discussed in Chapter 8, Nakamoto was clearly unpersuaded by the arguments of the standard macroeconomics textbook and more influenced by the Austrian school, which argues that the quantity of money itself is irrelevant, that any supply of money is sufficient to run an economy of any size, because the currency units are infinitely divisible, and because it is only the purchasing power of money in terms of real goods and services that matters, and not its numerical quantity. As Ludwig von Mises put it:

The services money renders are conditioned by the height of its purchasing power. Nobody wants to have in his cash holding a definite number of pieces of money or a definite weight of money; he wants to keep a cash holding of a definite amount of purchasing power. As the operation of the market tends to determine the final state of money’s purchasing power at a height at which the supply of and the demand for money coincide, there can never be an excess or a deficiency of money. Each individual and all individuals together always enjoy fully the advantages which they can derive from indirect exchange and the use of money, no matter whether the total quantity of money is great or small … the services which money renders can be neither improved nor impaired by changing the supply of money…. The quantity of money available in the whole economy is always sufficient to secure for everybody all that money does and can do.

Murray Rothbard concurs with Mises:

A world of constant money supply would be one similar to that of much of the eighteenth and nineteenth centuries, marked by the successful flowering of the Industrial Revolution with increased capital investment increasing the supply of goods and with falling prices for those goods as well as falling costs of production.

According to the Austrian view, if the money supply is fixed, then economic growth will cause prices of real goods and services to drop, allowing people to purchase increasing quantities of goods and services with their money in the future. Such a world would indeed discourage immediate consumption as the Keynesians fear, but encourage saving and investment for the future where more consumption can happen. For a school of thought steeped in high time preference, it is understandable that Keynes could not understand that increased savings’ impact on consumption in any present moment is more than outweighed by the increases in spending caused by the increased savings of the past. A society which constantly defers consumption will actually end up being a society that consumes more in the long run than a low savings society, since the low‐time‐preference society invests more, thus producing more income for its members. Even with a larger percentage of their income going to savings, the low‐time‐preference societies will end up having higher levels of consumption in the long run as well as a larger capital stock.

If society were a little girl in that marshmallow experiment, Keynesian economics seeks to alter the experiment so that waiting would punish the girl by giving her half a marshmallow instead of two, making the entire concept of self‐control and low time preference appear counterproductive. Indulging immediate pleasures is the more likely course of action economically, and that will then reflect on culture and society at large. The Austrian school, on the other hand, by preaching sound money, recognizes the reality

of the trade‐off that nature provides humans, and that if the child waits, there will be more reward for her, making her happier in the long run, encouraging her to defer her gratification to increase it.

When the value of money appreciates, people are likely to be far more discerning with their consumption and to save far more of their income for the future. The culture of conspicuous consumption, of shopping as therapy, of always needing to replace cheap plastic crap with newer, flashier cheap plastic crap will not have a place in a society with a money which appreciates in value over time. Such a world would cause people to develop a lower time preference, as their monetary decisions will orient their actions toward the future, teaching them to value the future more and more. We can thus see how such a society would cause people not only to save and invest more, but also to be morally, artistically, and culturally oriented toward the long‐term future.

A currency that appreciates in value incentivizes saving, as savings gain purchasing power over time. Hence, it encourages deferred consumption, resulting in lower time preference. A currency that depreciates in value, on the other hand, leaves citizens constantly searching for returns to beat inflation, returns that must come with a risk, and so leads to an increase in investment in risky projects and an increased risk tolerance among investors, leading to increased losses. Societies with money of stable value generally develop a low time preference, learning to save and think of the future, while societies with high inflation and depreciating economies will develop high time preference as people lose track of the importance of saving and concentrate on immediate enjoyment.

Further, an economy with an appreciating currency would witness investment only in projects that offer a positive real return over the rate of appreciation of money, meaning that only projects expected to increase society’s capital stock will tend to get funded. By contrast, an economy with a depreciating currency incentivizes individuals to invest in projects that offer positive returns in terms of the depreciating currency, but negative real returns. The projects that beat inflation but do not offer positive real returns effectively reduce society’s capital stock, but are nonetheless a rational alternative for investors because they reduce their capital slower than the depreciating currency. These investments are what Ludwig von Mises terms malinvestments—unprofitable projects and investments that only appear profitable during the period of inflation and artificially low interest rates, and whose unprofitability will be exposed as soon as inflation rates drop and interest rates rise, causing the bust part of the boom‐and‐bust cycle. As Mises puts it, “The boom squanders through malinvestment scarce factors of production and reduces the stock available through overconsumption; its alleged blessings are paid for by impoverishment.”

This exposition helps explain why Austrian school economists are more favorable to the use of gold as money while Keynesian mainstream economists support the government’s issuance of elastic money that can be expanded at the government’s behest. For Keynesians, the fact that the whole world’s central banks run on fiat currencies is testament to the superiority of their ideas. For Austrians, on the other hand, the fact that governments have to resort to coercive measures of banning gold as money and enforcing payment in fiat currencies is at once testament to the inferiority of fiat money and its inability to succeed in a free market. It is also the root cause of all business cycles’ booms and busts. While the Keynesian economists have no explanation for why recessions happen other than invoking “animal spirits,” Austrian school economists have developed the only coherent theory that explains the cause of business cycles: the Austrian Theory of the Business Cycle.