Authored by Shane Coules via The Mises Institute,

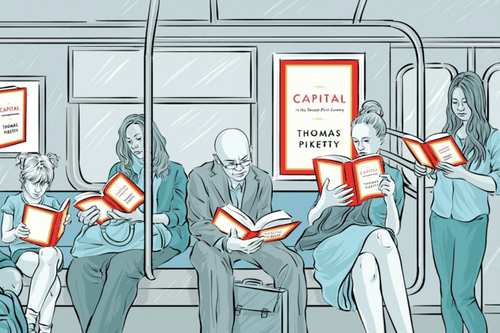

If you were to browse the economics section of the majority of bookstores here in my home city, Dublin, you would find something of an odd phenomenon: these businesses which essentially exist because of free enterprise and voluntary exchange—i.e., because of capitalism—stock very few books by promarket/procapitalism economists.

To be sure, when looking through the shelves, the most frequently encountered names include Karl Marx, John Maynard Keynes, Paul Krugman, and David McWilliams (the latter being Ireland’s most famous economist—a fellow at the Sanders Institute who believes housing and education should be free). Having paid close attention to this over the past few years when in these bookstores, I can say with absolute honesty that I have never seen books by F.A. Hayek, Thomas Sowell, James M. Buchanan, Murray N. Rothbard, Walter E. Williams, Ludwig von Mises, or even one of the best-known and least radical, relatively promarket economists, Milton Friedman. And I have rarely seen them in independent or secondhand bookstores here, too.

Why this is, we can only theorize. One reason might be because in the West today, the dominant culture in major institutions, mainstream media, and corporations is centered around leftism, and the bookstore owners themselves are merely responding to consumer demand; if criticism of capitalism (rightism) is in vogue—and it is—more people may be likely to read anticapitalist books and authors.

One of the economists on the left whose works regularly reside in these bookstores is, of course, one of the most popular and bestselling living economists—Thomas Piketty, who has seen an incredible rise in popularity in recent years. I decided to pick up one of his works from one of those promarket-starved bookshelves: Chronicles, a collection of his writings since the 2008 financial crisis. I also took to reading more articles about, and interviews with the man who says the world is ripe for “participatory socialism.” Here are some of the problems with Piketty and his book.

Patrimonial Capitalism and the Once Poor Billionaires

It doesn’t take long to encounter problematic and easily disprovable statements by the French economist who has been referred to as “the modern Marx.” In the preface of Chronicles, Piketty opines that “in the long run, patrimonial capitalism is the only kind that can exist.” You may be thinking, What is patrimonial capitalism? It essentially means that throughout history the economic elite attain their fortunes through inheritance, not through innovation or entrepreneurship.

This claim does not stand up under the least bit of scrutiny. For example, 327 of the people on the 1987 Forbes 400 (a list of the richest Americans) had dropped off the list by 2014. The remaining 73 were mostly self-made entrepreneurs and investors. Also, Steve Kaplan of Chicago Booth and Joshua Ruah of Stanford found that 32 percent of the Forbes 400 in 2011 came from very rich families, down from 60 percent in 1982. Indeed, it would suffice to look to the fact that a large number of billionaires in recent years came from poverty to confidently dump the theory of patrimonial capitalism into the bin.

Corporate Tax Rates and the Health of Nations

In many of the essays featured in Chronicles (with intriguing titles like “Europe against the Markets”) the man from Clichy criticizes the supposed lack of sufficient taxation of the superrich and corporations. Indeed, Piketty regularly calls for countries to increase their corporate tax rate.

But the corporate tax rate and general taxation do not tell the entire story of a country’s fortunes. Bosnia and Herzegovina has a lower corporate tax rate (9 percent) than the very wealthy Ireland (12.5 percent). The low rate has attracted some of the biggest companies on the planet, creating an abundance of jobs and economic growth. Bosnia and Herzegovina is one of the poorest nations in Europe. Of course, these are two very different countries, with the former having recently suffered through years of war. So, let us compare two prosperous European nations: Italy’s corporate tax rate stands at 28 percent (including municipal taxes), while Switzerland’s is 16.5 percent, yet Switzerland was recently ranked second in the world for quality of life, while Italy was fifteenth.

Outside of Europe, Venezuela is blessed with an abundance of natural resources and has one of the world’s highest corporate tax rates (34 percent), yet it is the poorest country in South America based on GDP. Singapore—relatively resource poor—has a corporate tax rate of 17 percent and its personal income tax rates are some of the lowest on the planet, yet it has regularly taken the top spot for quality of living in Asia.

A nation’s corporate tax rate, and indeed tax rates in general, are only one of the factors in how that nation functions and prospers—or doesn’t. Not only does Piketty recommend enforcing an “entirely European corporate tax rate” with a “minimum rate of 25% in each country,” but he has also gone on record as saying that under his tax plan, billionaires would be taxed out of existence.

Personal Freedom and EU Federalism

In an interview with the Economic Times, Piketty stated that one of the core differences between his work and that of Marx is that Piketty believes in private property and markets, because “these are also a condition of our personal freedom.”

For someone seemingly concerned with personal freedom, Piketty appears to have no issue with centralized EU command dictating to sovereign nations what their corporate tax rate should be. Nor does he seem to see any conflict between personal freedom and even greater European centralization. In Chronicles, he writes, “[T]he number one priority is to create a European authority capable of fighting the markets on equal terms. If that means submitting national budget bills to the European institutions, starting with the European Parliament, well then, let’s go ahead.”

For Piketty, European federalism is “The Only Solution,” to quote one of the titles in his collection of essays. That is, the transformation of the European Union from an informal union of sovereign states into a single federal state with a central government is what the economist desires. If Mr. Piketty were genuinely concerned about personal freedom, one would hope that he would prefer to see a decentralization of power and more control at the local level, rather than even more power for EU bureaucrats—the same EU that “bullied Ireland into bailing out the banks” with the taxpayer footing the bill. When it came to personal freedom, Irish citizens did not have much of a say in that one.

Inequality and Government Action

Inequality in and of itself is not bad. Rather, it is a natural consequence of a free society. To be fair, Piketty has said that “inequality is not a problem per se.” It is his opinion that extreme inequality is the problem. Thus, his target for fixing the ills of nations is, seemingly, always the wealthy and corporations.

But who decides what constitutes “wealthy”’? We could argue that the entire Western world is wealthy compared to the poorest countries on the planet. Should we increase taxes on every Western citizen and redirect money to these countries in a bid to reduce clearly extreme inequality? Or do the problems facing nations—including the world’s poorest—run deeper than money, as explained by the economist Angus Deaton?

And what of the role of government when it comes to the “wealth gap”? Could it be that government policies like overregulation and high taxes on lower and middle earners are often counterproductive, burdensome, and serve special interests? As Prince Michael of Lichtenstein says, “[A] huge industry of advisors, international organizations, and bureaucrats make gigantic profits from creating excessive regulations and then monitoring compliance with them.” We can also look to the draconian government-imposed lockdowns that have occurred over the past twelve months, which have hit those on low incomes hardest, while the ten richest billionaires in the world increased their wealth by $319 billion in 2020.

Contradictions and an Abundance of Praise

Despite all of this, Piketty has been and still is one of the most popular economists in the West. Go to any bookstore here in Ireland, at least, and you will see his titles on display, replete with quotes of glowing praise.

Keynesian economist Paul Krugman has been one of those to gush with acclamation, despite many of Piketty’s claims being debunked or disproved (see, for example, Indian economist Swaminathan Aiyar’s rebuttal of the French economist’s claims about India).

Of course, Piketty shares this “popularity” trait with many other hugely influential and regularly praised economists of the Left, like Keynes, Krugman and, of course, Marx. But perhaps the admiration for these economists makes sense: they talk about things like poverty, inequality, peace, and injustice – issues people care about. After all, what has economic freedom and voluntary exchange – capitalism – ever done for all of that?